tv Wall Street Journal Rpt. ABC November 11, 2012 7:00am-7:30am EST

7:00 am

jamie dimo welcome to the "wall street journal report." i'm maria bartiromo. the report from napa valley. what does a second term for president obama mean to the economy? i will talk to two former top presidential advisers and sea if they think we can avoid the fiscal cliff. how to stay safe and find the right sectors in the mark and jamie dienl of jpmorgan chase. regulation, policy and totoo bi to fail. the "wall street joual report" begins right now. >> here's a a look at what is making news as we head to a new week on wall street. if if toward thought they would get a bounce after the election,

7:01 am

they thought wrong. president obama's second term victory was greeted with stocks worst day of the year. the dow fell 300 points on wednesday and triple-digits on thursday and and the markets were mixed on friday. bond rating agency moody's reiterated the possibility of a downgrade if america goes over the fiscal cliff but sasaid it would wa wait after budget negotiations. a downgrade will make it more expensive for the united states to borrow money. superstorm sandy would provide an economic boost to the auto industry. 250,000 new and used cars may haveve been n ruined by sandy. a lossss that could eventually lead to a spike in auto sales. overall consumer borrowing expanded in september but at a slower pace than the previous month. a sign buyers may be pulling back on credit card purchases. this is an important point cause consumer and consumer spending make up two-thirds of the u.s. economy.

7:02 am

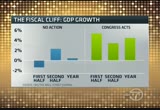

what will a second term for president obama mean to the economy? will we see compromise or fall over the fiscal cliff? joining me are two former top presidential advisers. laura tyson, chair of the economic advisers then for president clinton and marty feldstein who held the same title under president reagan. laura, marty great to have you on the program. thank you for spending the time today. >> thahank you. >> good to be with you. >> marty, both sides appear to be extending an olive branch when with it comes to the fiscal cliff. do you think we will reach a compromise? and if so how and when? >> i hope so. the consequence of not reaching the compromise for t american and world economy next year would be disastrous. we would be talking about very deep recession if we went over the cliff and didn't quickly bounce back from it. >> laura, you think there is a two-part solution. what do you mean by that? >> we have the fiscal cliff an

7:03 am

a need to get a long-run compromise plan on deficit reduction over the next decade. i think we have to be realistic, that the possible of getting the long-run plan over a six, eight-week period with a lame duck congress that is a low probabilitity event. i think w we have to think of this, can we find a way to negotiate a deal that gets us through the cliff. that deal says something about the framework and the content of the ten-year deficit reduction plan. get through the cliff first, we have to get a temporary deal to that and all t the risks that marty says are very serious but that has to be linked to the outline, the framework for a ten-year deal. >> one way of doing it is to have a postponement for, say, six months, and then if they don't reach a compromise, a ten-year plan that laura talked about, to have moreonstructive

7:04 am

thing than the kind of cuts that are i involved in the cliff. >> it seems so silly and petty to fight over taxes, but i have to say i have been optimistic the last few days hearing from both sides. you have to say that both sides seem ready to deal. >> i think that's the right way to go. not to push the tax rate up, but to raise revenue by broadening the tax base by putting an overall limit, an overall cap on the extent to which individuals can benefit from these tax expenditures. >> i actually think all of those comments are promising and i think the path that marty has suggested is one reasonable path that needs to be considered. my concern is that the fiscal cliff involves those tax rates that's for t the top250,000 a year and higher. and that's ere you have the

7:05 am

biggest cleavage between the right wing and the left wing with some people on the left saying we should do the fiscal, wely go over the cliff if we cannot raise those rates and others on the republican side saying that is the last thing we will do. i think we may have to essentially get through the kind of temporary extension arrangement, which gets that cleavage off the table. >> it's interesting what's going on. now we're sort of at the precipice wouns once again and seeing real ideas to compromise. let me ask you about the idea of a recession. most economists agree if we go over the call cliff we will dmip to recession in 2013. do you both agree with that? >> absolutely and it will be a serious one if we go over. it is not just a technical thig where e after a couple of weekse will reverse and put taxes back

7:06 am

where they have been before. that jump in taxes the cbo tells us will take some billion out of the economy next year. about 4% of gdp. >> yes. i completely agree. it's causing -- it really is causing significant uncertainty in the business community. there's evidence of changes in investment strategies and employment strategies because of the uncertainty around the large spending cuts, particularly in defense that would occur next year as part of the cliff, if we go over the cliff. so this is very, very dangerous. i think we just all have to keep repeating that policymakers cannot, should not -- it would be irresponsible to hold the u.s. economy hostage, particularly if it is one around a narrow issue, which is the top tax rates for a relately small percentage of people. >> let me ask you about the second most pressing issue and

7:07 am

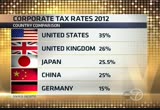

that is jobs, employment. what should the second obama administration do to encourage job creation? marty? >> i think getting the uncertainty of higher taxes off the table would help. i think corporate tax reform would also help. president obama has said that he would bring the top rate down. the corporate rate down from 35 to 28%. that would get us in line with the the major european economy. thatat would be a good thing. if we took the next step and went to the international tax rules that every other industrial country has, so-called territorial system, that would encourage american firms to bring back some of the literally more than a trillion dollars of funds that they have sitting outside of the u.s. economy. >> whahat about the health care legislslation? now that president obama has been re-elected, we know obama care, affordable care act is not going anywhere. after all of this debating about

7:08 am

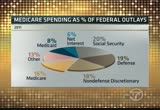

it. what impact do you think that will have? >> let me underscore my agreent with marty. we worked together on corporate tax reform in president's economic recovery advisisory bod and i think it would be very important and maybe an area of tax reform where it is easier to get agreement among centrist democrats and republicans is in the corporate air. on medicare, i'm optimistic -- or on health care. if you look at the phase in. what the cbo has said is over the first decade of obama care we will save $100 billion. that's not a lot of money, but we will be ensuring 30, 40 million additional americans. their projection right now is that in the second decade we will shave off the rate of growth of health care spending about a trillion dollars from the medicare deficit. that's really good news. we could phase in a lot of the reformrms in obama care more quickly, such as the accountable

7:09 am

care organization, and make those savings occur even sooner. >> great to talk to you. thank you for joining us today. > good d to be with you. >> tha you, maria. >> we will s you soon. marty feldstein and laura tyson. up next on the "wall street journal report" we have talke about the economy under a second obama presidency but what about the markets and your money. we will find the investing moves and how to otect yourself. when you think babankers, y think jamie dimon. we will talk regulation politics and policy. back in a moment. [ female announcer ] today, it's not just about whoives in the white house, it's about who lives in the yellow house the green, and the apartment house, too. today we n not only honorr thoval office,

7:10 am

but we honor the cubicle, and the home office as welll. bse today it's about all of us. and no mamatter who you are, you're the commander-in-chief of your own life. ♪ ke a closer look... you're the commander-in-chief of your own life. ...at the best schools in the world... ...you see they all have something very interesting in common. they have teachers.. ...with a deeper knowledge their subjects. as a rult, their students achieve at a higher level. let's develop more stars inducation. let's invest in our teachers... ...so they can inspire our students. let's solve this.

7:12 am

plunging having the worst day of the year. its greeting to news for a second term of obama. how can you protect your money? is this likely to be a short-term blip or a long-term problem. joining me is jack ablin. good to have you on the program. >> thank you, maria. >> what a greeting the markets gave president obama's re-election, the huge selloff. do you think this is political nerves, fundamental problems? what is behind that and is it sustainable and long lasting? >> think it was reaction to revelations of new regulations, new taxes, things like that. if you look at the sectors hardest hit were financials because of the tighter regulations, tougher to do business, but also energy, same thing, on the coal and the environmental side there. so i think those two were kind of what i will call a reset. >> would you buy in to the

7:13 am

selloff or do you want to take to the sidelines. the market has done well under president obama. i realize it is probably the free money and the stimulus from the federal reserve that that has driven the market but the nasdaq is up 90%, the dow up 50%, s&p 5005 up 60%. was this an over reaction and would you look for opportunities to get in? >> i think, i would say fundamentally we are looking for s&p earnings of $100 a share next year. that is somewhat lower than what total year 2012 will be. we're also below consensus, but even still, $100 a share should support 1400 in the s&p which is higher than it is right now. should support 1450, potentially even 1500. i would say we're in a range bond market in the u.s. and it's going to be subject to a lot of headlines we will read. >> what sectors do you think will do well under an obama presidency.

7:14 am

what do you want to avoid and what about the dividend payers and banks, as well. >> sure. the sector most insulated from increased regulation is technology. generally technology isn't a heavily regulated industry any way. and they don't really pay a high dividend. >> the question is will we see a end of year zell selloff as toward try to lock in profits when tax rates are lower verse us next year when they go up. but how high will they go up on the dividend payers? >> right now, president obama's propose al would have dividends taxed at ordinary income. that is subantially higher t rate than the 15% tax rate that toward are enjoying right now. either way, we think that dividend yields will ultimately get dinged. as you mentioned, they have gotten hit. they were down something like 3% and the week ending just before

7:15 am

the election. even in anticipation of that. it's hard to know. remember, a lot of dividend stocks are held in tax-exempt accounts, 401(k)s, pensions, endowments, foundations. we are dealing with a subset here. my sense is we will not see a pull back becau a lot of dividends aren't taxed to the extent you would think. >> good to have you on the program. thank you so much. >> thank you, maria. >> up nextt on the "wall street journal report," he run what some think is the strongest bank. what will life be life undnder president oba's next four years? [ le announcer ] how can power consumptioin china,

7:16 am

impact wool exports from newealand, textile production in spain, and the use of medical technology in the u.s.? at t. rowe price, we understand the connections of a complex, global economy. it's just one reason over 75% of our mutual funds beat their 10-year lipper average. t. rowe e price. inst with confidence. request a prospectus or summary prospectus with investment information, risks, fees and expenses to read and consider carefull. railroads plan to spend $23 billion on their network.ht that's like building 4 nat's stadiums, 5 wilson bridges, and 8 dc convention centers...all in one year. and not a penny of it comes from taxpayers.

7:18 am

freight railroads plan to spendd $23 billion on their network. that's like launching 4 mars rovers, 10 gps satellites, and 20 space shuttles ...all in one year. and not a penny of it comes from taxpayers. if you want to know what jamie dimon thinks, just ask. the outspoken chairman of jpmorgan chase is an important voice for the financial industry and not short of opinions. i oke to him about politics, policy and regulation this week. >> the foundation of business is pretty strong. companies are in good shape, a lot of cash. middle market companies, small business. if you look at the numbers, housing looks like it is turning, household formation is going up. business itself looks pretty good and i think the american economy -- to me the most

7:19 am

important thing is we solve the short-run fiscal cliff and the long rloun issues and if we do that the economy can boom. hope that proem works on that and i think he has been working on that. >> what are the implications of going over the fiscal cliff you have taken a lead in terms of fix the debt. what are the implications of going off the fiscal cliff and not getting anything done by year end. >> let's separate the two. more g jpmorgan is one of the c compans involved. we need a solution. business is supportive of a solution that fixes the problem. we're not religious about the issues of taxes and spending. we want a rational thoughtful solution. the cliff is decemr 31st, midnight, $600 billion will come out of the economy. the economy drops by 3 or 4%. but the world is t static what

7:20 am

may happen is before december 31st you could see the effects and it might be worse as peopl try to react and protect themselves from a possible impending recession. dodd frarank volker issues don't go away under president obama. the question is do they get worse? if we see elizabeth warren on the banking committee. what's your take. >> i called her to congratulate her for winning her election. we worked together well. we are going to meet all of the rules and requirements in the spirit and letter of the law. the most important thing is while doing that we can serve the corporations, consumers, businesss. those things may change pricing, some returns and businesses but i think we can meet them all. the only one that has us cautious is where jpmorgan isn't allowed to compete on the same terms that deutsche bank or chinese bank. that's all. >> is there a way to work

7:21 am

together? you said yourself at the top of the industry business is doing else well. all we need to do is unlock that. >> i came back from a two-week trip in asia, entrepreneurs, social and media. asia has growth oppoportunities. this is the grereatest economic engine ever r by when you go around here the capability to spend capital expendures. america is the best there is. to me this is the greatest engine. it is growing slowly and waiting to be ignited. i have enormous respect for the president but business and government colliding has a better chance than antagonist behavivior. i was asked at what wint president obama is elected, will this work? >> hopefully it will take

7:22 am

everyone a bit to say let's start to collaborate. >> what about housing? the last time we spoke a year ago, more than that, actually you said housing bottomed. you stand by that? >> yeah. everything is flashing green. not one thing is flashing red. we are creating 3 million americans more every year, homes for sale is six months supply, the inventory which is high but the fact it is coming down. banks are better at short sales. all-time affordability of homes and mortgages. home prices in the worst markets are now up. phoenix is up 20 to 30%. >> that is one of the hardest hit. >> vegas, miami, sacramento is up. it is not an absence of a strong economy. the economy will drive housing but if we get the economy going housing has clearly turned and the important thing to remember if it goes back to normal building 1.3 million units a year, 1.4 which most economists say we will have to do soon

7:23 am

because we have added 15 miion americans this the last four five years or so. that will add 2 million jobs right there. housing could be the thing that helps to drive the e economy ife get this economy going. >> you have all of these technology ceos and social media, new technology ceos meeting together in this conference. why is this sector so important to you? is that where the vibrancy of business is today? >> remember we do basic banking like loans but we have 12 million mobile accounts now. peoplele are moving money. you can take pictures of checks and have them deposited. use quick pay to send money to friends and debit your account. these services will grow rapidly. i have been meeting folks and making sure we understand and are gearedd up for it. on-line-l banking and moving of money, electronic exchanges that has been happening my whole life. ththis is another huge wave of things to make it better for

7:24 am

customers. we have to do it. we will invest a huge amount of time and minute to make sure we serve customers properly in the mobile and digital world. >> my thanks to jamie dimon. up next we will look at the news this week that will have an impactim on your money. attention wal-mart shoppers. why your turkey day schedule maybe different from everyone else in your family. stay with us. world... ...you seehey all have something very interesting in common. they have teachers... ...with a deeper knowledge of their subjects. as a result, their students achieve at a higher level. let's develop more stars in educacation. let's invest in our teachers... ...so they can inspire our students. let's solve this. aflac... and major medical? major medical, boyyy, yeah! [ beboxing ] berr, der berrp... ♪ i help pay the doctor

7:25 am

♪ ain't that enough for you? ♪ the's things major medical doesn't do. aflac! pays cash so we dodon't have to fret. [ togethther ] ♪ something families should ge♪ ♪ like a safety net ♪ help with food, gas and rent, so covover your backwith... ♪ a-a-a-a-a-a-a-aflac! [ male announcer ] help prott yourur family at aac.com. [ beatboxing ] a short word that's a a tall order. up your game. up the ante. and if you stumble, you get back up. up isn't easasy, and we ought to ow. we'rin the business of up. everydayelta flies a quarter of million people whilile investing billions improving everythi from booking to baggage claim. we're raising the bar on flying and tomorrow we will up it yet again.

7:27 am

for more on our show and our guests, check out the website and i hope you will follow me on twitter and google+. look for @maria bartiromo. now look at the stories in the week ahead that may prove the market and impact your money this week. earnings reports are out from home ddepot, wal-mart and cisco. cisco was downgrade on friday. monday, veteran's day is observed. the bond market and will be closed. and we will get retail sales numbers for october. a sign of how well the consumer is doing and consumer price number. and on thursday the consumer price index which measures inflation for consumers. if you were planning to watch football after thanksgiving dinner this year, you may want to reconsider wal-mart says it will kick off the holiday sales rush at 8 p.m. on turkey day this year. the world's largest retailer is

7:28 am

betting on the eagerness of consumers to spend big this season. a critical time of the year for what amounts to a quarter of wal-mart's annual sales. we may have to rename black friday. that will do it for us. thank you for joining me. join us next week. we will be talking about america's energy source, natural gas, fracking than environment. each week keep it here where wall street meets main street. i will so see you next weekend.

91 Views

IN COLLECTIONS

WJLA (ABC) Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11